Welcome

- Home

- About Us

- Book a Valuation

- FREE Instant Valuation

- Meet The Team

- Independent Customer Reviews

- GBP Estates Blog

- Guild Membership

- Guild Market News

Posted on: Monday, September 11, 2023

Despite challenging economic conditions, the market remains resilient, in part due to motivated buyers still looking for correctly priced homes. Activity amongst first-time buyers is holding up well.

July and August are typically slow months for selling properties. Summer holidays, outdoor activities and children off school mean that our thoughts are elsewhere. In August we have historically seen an average month-on- month fall of 0.9% (Rightmove). This year the figure is higher at 1.9%, an indication of growing realism in the market and keen vendors pricing competitively to attract buyers. Despite the current softening in prices, average house prices in May were down just 2% on last September’s high and still over 20% above pre-pandemic levels (Zoopla).

In light of improving inflation data and more positive forecasts for the UK economy, lenders have been cutting their fixed mortgage rates. The quarterly growth rate of mortgages approved has improved from the start of the year, with lending volumes 6.3% higher over the three months to the end of July than they were for the prior three months. Whilst current levels are higher than at the end of 2022 and early 2023, they are considerably lower than a year ago (Bank of England).

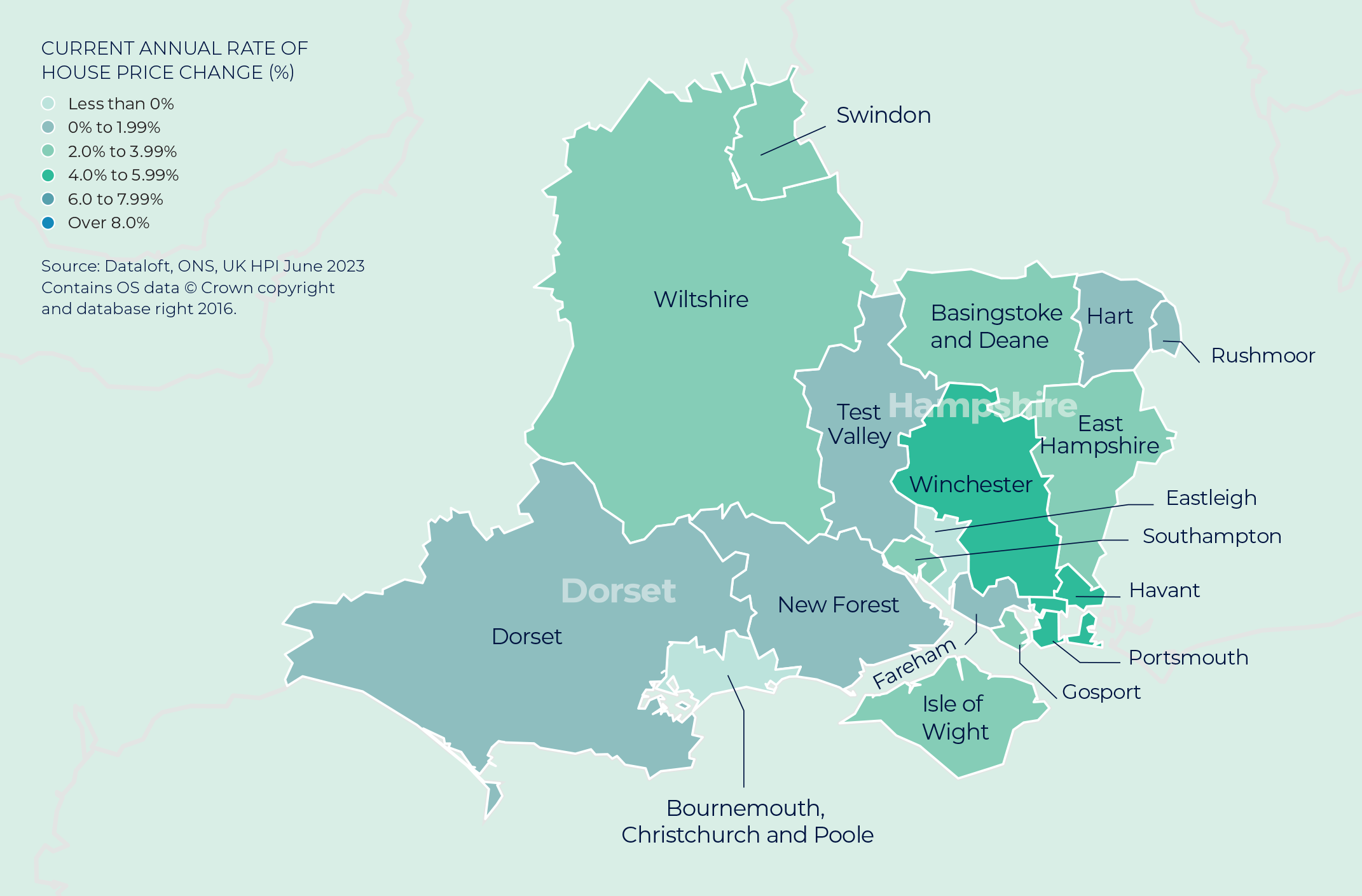

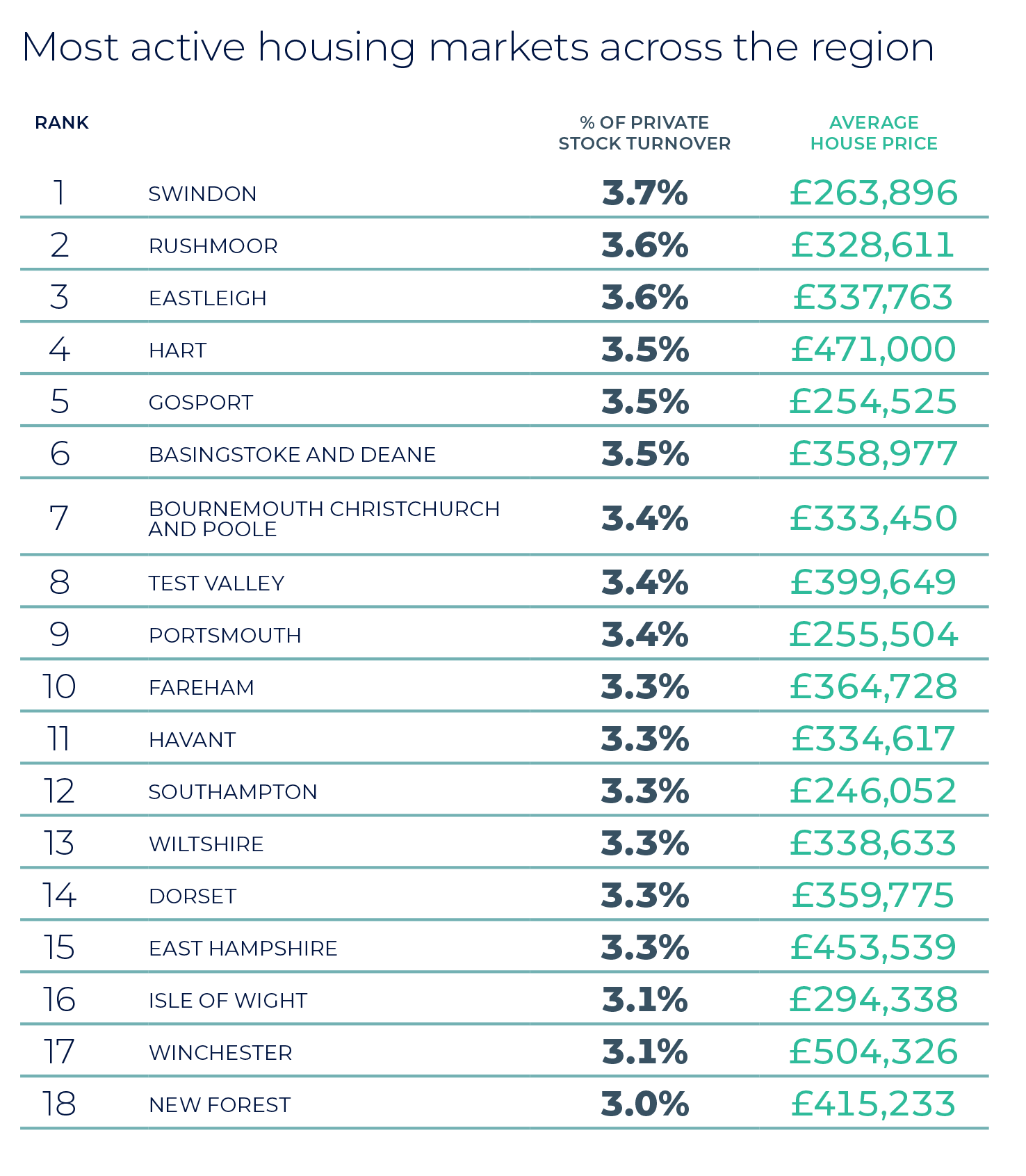

At 1.3% and 0.5%, annual property price growth in the South East and South West respectively has moderated from 5.7% and 6.1% at the start of the year. However, it remains in positive territory. Price growth is currently strongest in Winchester, Havant and Portsmouth.

The supply of properties is constrained, with the number of available properties 10% lower than the same time in 2019, in part preventing more significant price falls so far this year (Rightmove). Homes are selling more quickly, with the average time to secure a buyer standing at 55 days compared to 61 days in 2019 (Rightmove).

With 6.5% of homes for sale seeing cuts of over 5% to asking prices, a level that is 60% above the five-year average (Zoopla), buyers are becoming more price sensitive and the importance of pricing right the first time is paramount. Realistically priced homes are still seeing multiple prospective buyers.

The sales market is proving resilient despite high mortgage rates and cost-of-living pressures. Average asking prices across the UK in Q2 2023 are higher than Q1, and up by 24% on 2019, with the gap between initial asking and exchanged prices similar to pre-pandemic levels (TwentyCi). The market has shifted in favour of buyers, with 70% of agents surveyed saying it is a buyer’s market and just 3% saying sellers are more in control (Dataloft Inform Poll of Subscribers).

In light of higher mortgage rates and high living costs, sales volumes have taken a hit, with some people delaying moving or looking for smaller, more affordable homes. This means there continues to be different patterns across different parts of the market and different property types. There was stronger performance in more affordable markets such as Scotland and the North West, compared with more expensive areas such as London and the South East.

Sell your property with your local expert this autumn. Contact your local Guild Member today.